The credit limit will depend on your overall credit history, and Petal will allocate a credit limit between $500 to $5000. Petal 1 also offers a rewards program to earn two to ten percent cashback on purchases with select merchants. They have no annual fee, and the APR varies between 19.99 to 29.49%. The Petal 1 credit card is another unsecured credit card. The annual percentage rate varies between 26.99% to 28.99%. The Mercury card is unsecured, has no annual fee, and customer reviews indicate that a starting credit limit of $1500 is quite common. If your credit score is in the 575 to 675 range, you might be interested in the Mercury Mastercard.

First savings credit card free#

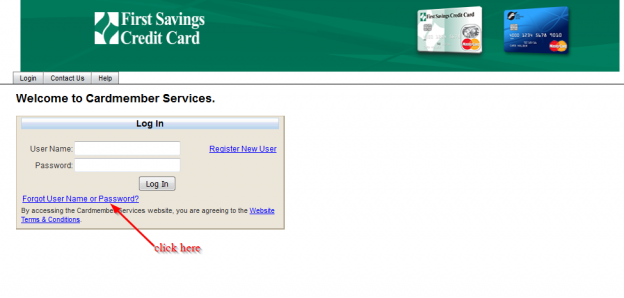

calichtenberger2, August 7th, 2021, WallethubĪlso, multiple credit card users mentioned issues with payments being processed late and limiting how many free payments you can process within a month through the online portal. Has reported to the credit bureaus but I have yet to receive the physical card…… Dani H,, BBBĭO NOT GET THIS CARD! Not only do they renege on the 6 months payments on time and get a credit increase (my debt ratio was to high, according to them) but they charged me for a late payment on the exact due date with a payment already pending in their system. Got an offer for 1500 Only a 500 dollar limit was put on it. While some cardholders accept the card as a basic rebuilder Mastercard, others are disappointed by the unfulfilled promises initially received on their invitation card. The First Savings Mastercard gets a mix of positive and negative reviews. Get Started Now! First Savings Credit Card Reviews There you want to click on the green button like the one below.Ĭredit Monitoring Made Easy. Once you have that in hand, you can head over to the website.

First savings credit card how to#

How to Apply for a First Savings Mastercardįirst, you will need to receive your invitation in the mail.

A high APR: Unless you are approved for Offer 1, you will be offered an APR of 29.9%, which is high.By invitation only: One of the cons for the First Saving credit card is the inability to apply without an invitation nor the ability to request an invitation.Use Nationwide: Your First Savings Mastercard gives you the freedom to use your credit card wherever Mastercard is accepted.Mobile and online friendly: Payments can be made through the online portal, and you can also use the First Savings app to manage your account conveniently.Credit limit increases: Users report that their invitations state a credit limit increase will occur after making six timely monthly payments.Make your monthly payments on time and start rebuilding your credit score. Reports to the credit bureaus: All three major credit bureaus (Equifax, Experian, and TransUnion) will receive updates on your payment activity.No security deposit required: If funds are tight and you are searching for an unsecured credit card, the First Savings Mastercard does not require a deposit.The First Savings credit provides the opportunity to such applicants. Qualify even with bad credit: Finding a credit card to rebuild your credit can be a struggle when your credit score is low.First Savings Mastercard Pros and Cons Pros For Offer 1, the costs are $10 or 4% of the cash advance amount.įor Offers 4 and 5, the fees are currently 2% of each cash advance. The fees for cash advances also vary between offers. Let’s review some of the main differences among the three credit card agreements. Unfortunately, the First Savings Mastercard site does not specify each offer’s credit score requirements.īut if your credit score is very low, you are likely to only qualify for the contracts that come with a higher APR and fees.

While there are five contracts listed on the website, only contracts 1, 4, and 5 are for the First Savings credit card. If you want to apply, you will have to await a pre-approval in the mail.īut the First Savings bank credit card is a little more unique as it offers different plans depending on your creditworthiness.

Start Now First Savings Credit Card Overviewįirst Savings Mastercard joins the ranks of the Mercury and Destiny Mastercard in that all three cards are accessible by invitation only.

0 kommentar(er)

0 kommentar(er)